All Categories

Featured

Table of Contents

Ideal Company as A++ (Superior; Top group of 15). The score is since Aril 1, 2020 and is subject to transform. MassMutual has obtained various ratings from various other score companies. Place Life And Also (Plus) is the marketing name for the And also rider, which is consisted of as component of the Place Term policy and supplies access to extra services and advantages at no charge or at a discount.

If you depend on someone financially, you may question if they have a life insurance coverage plan. Learn exactly how to discover out.newsletter-msg-success,.

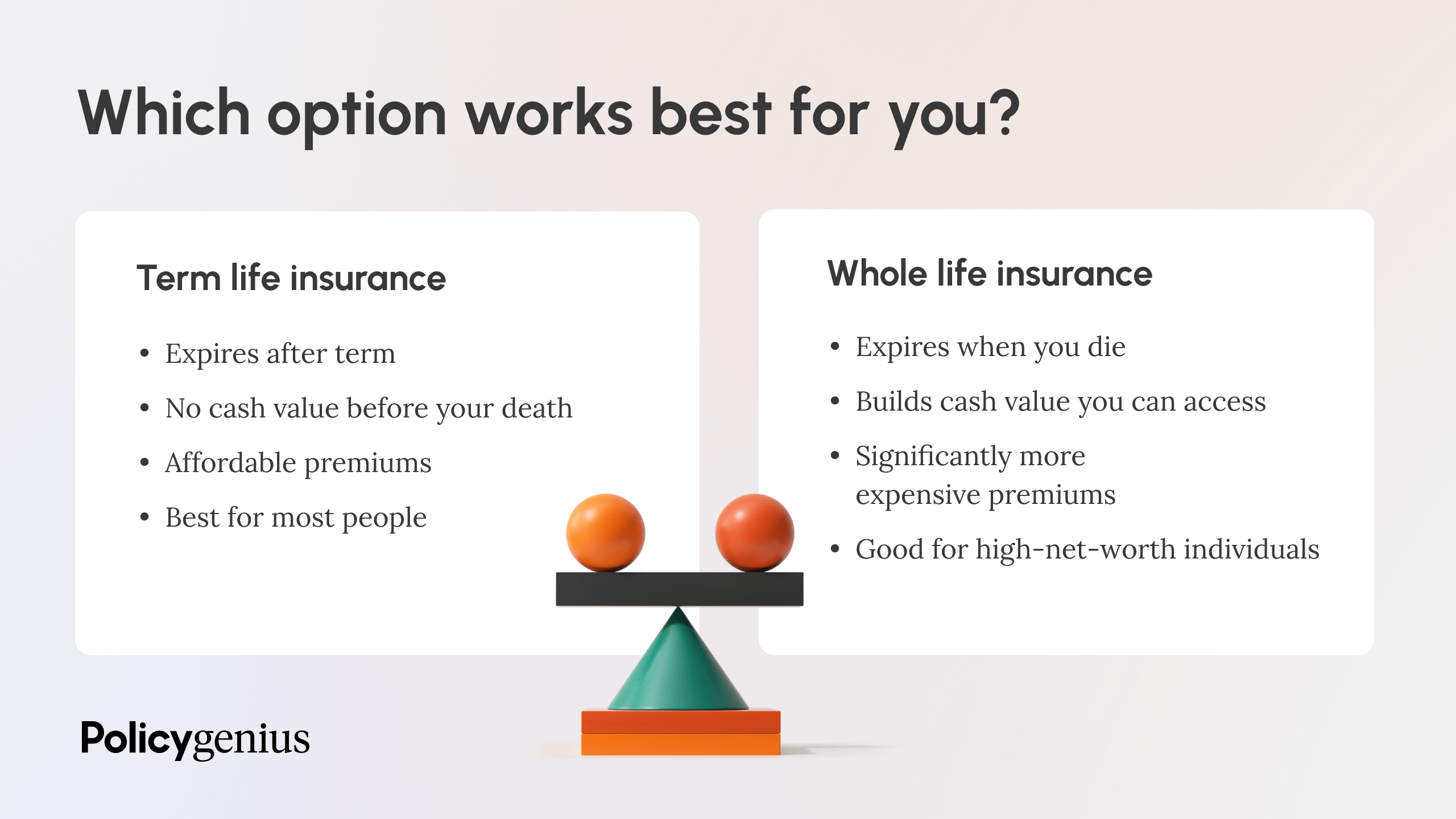

There are numerous sorts of term life insurance plans. As opposed to covering you for your entire life expectancy like entire life or universal life plans, term life insurance coverage just covers you for an assigned time period. Policy terms typically vary from 10 to three decades, although much shorter and longer terms may be readily available.

If you desire to preserve coverage, a life insurance firm might offer you the option to renew the policy for an additional term. If you included a return of costs cyclist to your plan, you would obtain some or all of the cash you paid in premiums if you have outlasted your term.

How much does Best Level Term Life Insurance cost?

Degree term life insurance policy may be the ideal alternative for those that desire protection for a collection time period and desire their premiums to remain stable over the term. This may apply to shoppers concerned about the affordability of life insurance policy and those that do not want to change their survivor benefit.

That is because term plans are not guaranteed to pay, while irreversible plans are, provided all premiums are paid. Level term life insurance policy is usually more costly than lowering term life insurance policy, where the death benefit reduces gradually. In addition to the kind of plan you have, there are numerous various other factors that aid identify the expense of life insurance policy: Older applicants normally have a higher death threat, so they are typically more expensive to insure.

On the other hand, you might be able to secure a cheaper life insurance policy rate if you open up the policy when you're more youthful - Level term life insurance for young adults. Similar to sophisticated age, inadequate health and wellness can additionally make you a riskier (and extra expensive) prospect forever insurance policy. Nevertheless, if the problem is well-managed, you might still have the ability to discover cost effective coverage.

Health and age are usually much more impactful premium aspects than sex., might lead you to pay more for life insurance. High-risk work, like window cleaning or tree cutting, may also drive up your cost of life insurance.

What is the most popular Tax Benefits Of Level Term Life Insurance plan in 2024?

The very first step is to establish what you need the plan for and what your budget plan is (Level term life insurance rates). When you have an excellent idea of what you want, you might wish to contrast quotes and policy offerings from numerous business. Some firms supply online pricing estimate permanently insurance policy, but numerous require you to contact a representative over the phone or personally.

The most popular kind is currently 20-year term. Many firms will not market term insurance coverage to a candidate for a term that finishes previous his/her 80th birthday celebration. If a plan is "eco-friendly," that suggests it continues effective for an added term or terms, as much as a specified age, also if the wellness of the insured (or other aspects) would cause him or her to be denied if she or he used for a new life insurance coverage policy.

Costs for 5-year sustainable term can be level for 5 years, after that to a new rate mirroring the brand-new age of the insured, and so on every 5 years. Some longer term plans will guarantee that the costs will not enhance during the term; others do not make that guarantee, enabling the insurer to elevate the price throughout the plan's term.

This suggests that the policy's proprietor can change it into a permanent kind of life insurance policy without additional evidence of insurability. In the majority of sorts of term insurance coverage, including home owners and car insurance policy, if you have not had a case under the policy by the time it ends, you get no reimbursement of the premium.

Level Term Life Insurance Premiums

Some term life insurance policy consumers have actually been unhappy at this result, so some insurance providers have actually created term life with a "return of costs" attribute. The premiums for the insurance with this attribute are usually significantly greater than for policies without it, and they normally need that you maintain the policy active to its term or else you forfeit the return of premium benefit.

Degree term life insurance premiums and fatality benefits remain regular throughout the policy term. Level term life insurance is generally extra affordable as it does not build cash worth.

While the names typically are made use of interchangeably, level term insurance coverage has some crucial differences: the premium and fatality advantage remain the exact same for the duration of insurance coverage. Level term is a life insurance coverage policy where the life insurance premium and fatality benefit stay the exact same throughout of insurance coverage.

These policies can last for a 10-year term, 15-year term, 20-year term or 30-year term. The size of your insurance coverage period may rely on your age, where you remain in your profession and if you have any dependents. Like other kinds of life insurance policy coverage, a level term plan gives your beneficiaries with a survivor benefit that's paid if you pass away throughout your protection duration.

Who offers Guaranteed Level Term Life Insurance?

That normally makes them a more affordable choice forever insurance coverage. Some term plans might not maintain the costs and survivor benefit the very same with time. You don't wish to mistakenly believe you're buying level term insurance coverage and afterwards have your survivor benefit modification later on. Lots of individuals get life insurance coverage to aid monetarily secure their loved ones in instance of their unexpected fatality.

Or you might have the choice to transform your existing term insurance coverage into a permanent plan that lasts the rest of your life. Various life insurance coverage policies have possible benefits and downsides, so it's essential to comprehend each prior to you choose to acquire a plan.

Latest Posts

The Best Funeral Cover

What Type Of Insurance Is Final Expense

How Much Does Funeral Insurance Cost