All Categories

Featured

Table of Contents

- – What are the benefits of Level Premium Term Li...

- – Who offers flexible Level Death Benefit Term L...

- – Why should I have Level Term Life Insurance P...

- – What are the benefits of Level Term Life Insu...

- – Can I get Level Term Life Insurance For Fami...

- – What is the difference between Level Term Li...

- – Who are the cheapest Affordable Level Term L...

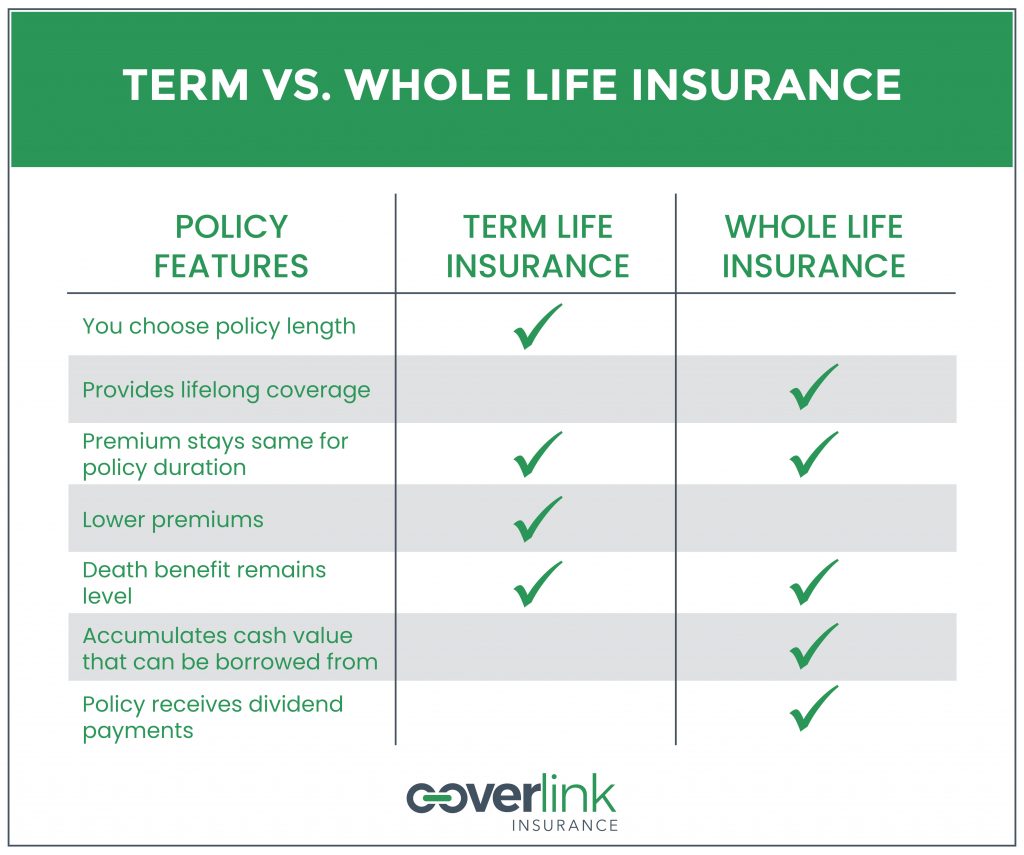

The main differences in between a term life insurance policy and a permanent insurance coverage plan (such as entire life or universal life insurance) are the period of the plan, the buildup of a money value, and the expense. The appropriate choice for you will certainly depend upon your needs. Below are some things to think about.

Individuals who have whole life insurance policy pay extra in premiums for much less coverage but have the security of recognizing they are protected for life. Level death benefit term life insurance. Individuals who buy term life pay premiums for an extensive period, however they get nothing in return unless they have the misery to pass away prior to the term expires

The performance of permanent insurance coverage can be constant and it is tax-advantaged, providing extra benefits when the supply market is unstable. There is no one-size-fits-all response to the term versus permanent insurance coverage dispute.

The rider assures the right to convert an in-force term policyor one about to expireto a long-term plan without undergoing underwriting or proving insurability. The conversion motorcyclist must permit you to convert to any type of long-term plan the insurer provides without any constraints. The primary features of the motorcyclist are maintaining the original health and wellness score of the term policy upon conversion (also if you later have wellness problems or become uninsurable) and making a decision when and just how much of the insurance coverage to convert.

What are the benefits of Level Premium Term Life Insurance?

Obviously, general premiums will certainly increase dramatically since entire life insurance policy is extra pricey than term life insurance policy. The benefit is the assured authorization without a clinical examination. Clinical conditions that establish during the term life duration can not create costs to be boosted. However, the firm might require restricted or full underwriting if you wish to add additional motorcyclists to the brand-new plan, such as a long-term care biker.

Term life insurance policy is a fairly inexpensive means to offer a swelling amount to your dependents if something occurs to you. If you are young and healthy, and you support a family members, it can be a good option. Entire life insurance policy comes with significantly greater monthly costs. It is meant to give insurance coverage for as long as you live.

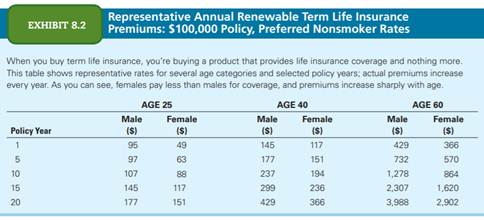

Insurance coverage firms established a maximum age restriction for term life insurance plans. The premium likewise increases with age, so a person aged 60 or 70 will pay significantly more than a person years younger.

Term life is rather similar to auto insurance coverage. It's statistically unlikely that you'll require it, and the premiums are cash away if you do not. However if the worst occurs, your family will get the advantages.

Who offers flexible Level Death Benefit Term Life Insurance plans?

A level premium term life insurance coverage plan lets you stay with your spending plan while you aid secure your family. Unlike some tipped price plans that enhances every year with your age, this type of term plan provides prices that remain the exact same through you choose, even as you age or your health adjustments.

Find out more about the Life Insurance alternatives offered to you as an AICPA member. ___ Aon Insurance Services is the trademark name for the broker agent and program management operations of Affinity Insurance policy Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Agency, Inc. (CA 0795465); in Okay, AIS Affinity Insurance Coverage Solutions Inc.; in CA, Aon Affinity Insurance Providers, Inc.

Why should I have Level Term Life Insurance Policy?

The Plan Representative of the AICPA Insurance Trust Fund, Aon Insurance Services, is not connected with Prudential. Group Insurance policy insurance coverage is issued by The Prudential Insurer of America, a Prudential Financial company, Newark, NJ. 1043476-00002-00.

Generally, there are 2 sorts of life insurance policy prepares - either term or permanent strategies or some combination of both. Life insurance companies supply numerous types of term plans and conventional life policies as well as "rate of interest delicate" products which have actually come to be much more widespread given that the 1980's.

Term insurance policy provides protection for a given period of time - Level term life insurance calculator. This period can be as brief as one year or offer protection for a details number of years such as 5, 10, two decades or to a specified age such as 80 or in many cases as much as the earliest age in the life insurance policy death tables

What are the benefits of Level Term Life Insurance Policy?

Presently term insurance rates are really competitive and amongst the most affordable traditionally skilled. It needs to be noted that it is a commonly held belief that term insurance coverage is the least costly pure life insurance protection offered. One needs to examine the plan terms meticulously to decide which term life choices appropriate to fulfill your certain scenarios.

With each new term the premium is increased. The right to restore the policy without evidence of insurability is a vital benefit to you. Or else, the risk you take is that your health and wellness may weaken and you might be incapable to acquire a policy at the same prices or perhaps in any way, leaving you and your beneficiaries without insurance coverage.

The length of the conversion period will certainly vary depending on the type of term policy acquired. The costs rate you pay on conversion is normally based on your "existing acquired age", which is your age on the conversion date.

Can I get Level Term Life Insurance For Families online?

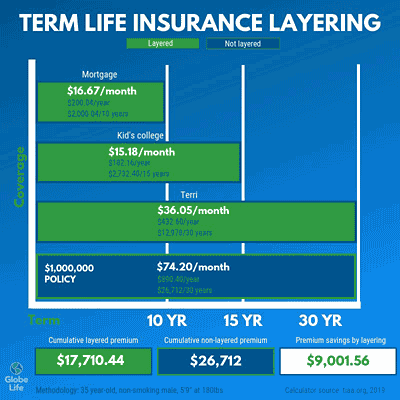

Under a level term policy the face amount of the plan stays the same for the whole period. With reducing term the face amount lowers over the duration. The costs stays the very same each year. Typically such policies are offered as mortgage defense with the quantity of insurance lowering as the balance of the mortgage lowers.

Generally, insurers have actually not deserved to change premiums after the plan is marketed. Because such policies might continue for lots of years, insurance companies should make use of conventional death, interest and cost price estimates in the costs estimation. Adjustable premium insurance, however, allows insurers to provide insurance policy at reduced "current" costs based upon much less conventional presumptions with the right to change these costs in the future.

While term insurance coverage is developed to give defense for a specified period, long-term insurance policy is made to offer coverage for your whole lifetime. To maintain the premium rate level, the costs at the younger ages surpasses the actual price of security. This added premium builds a get (cash value) which aids pay for the policy in later years as the cost of protection increases above the costs.

What is the difference between Level Term Life Insurance For Young Adults and other options?

With level term insurance coverage, the price of the insurance will certainly remain the same (or potentially lower if dividends are paid) over the regard to your policy, normally 10 or twenty years. Unlike irreversible life insurance policy, which never ever ends as lengthy as you pay costs, a level term life insurance policy plan will finish at some point in the future, commonly at the end of the period of your degree term.

Due to this, lots of people use irreversible insurance coverage as a stable monetary planning device that can offer lots of requirements. You may be able to convert some, or all, of your term insurance policy during a set duration, generally the initial one decade of your policy, without requiring to re-qualify for insurance coverage also if your health has changed.

Who are the cheapest Affordable Level Term Life Insurance providers?

As it does, you might desire to include in your insurance protection in the future. When you initially get insurance coverage, you might have little savings and a big home loan. Eventually, your savings will certainly expand and your mortgage will reduce. As this happens, you might wish to ultimately lower your survivor benefit or take into consideration converting your term insurance policy to a permanent plan.

Long as you pay your premiums, you can relax easy understanding that your enjoyed ones will certainly obtain a death advantage if you die throughout the term. Lots of term policies enable you the capacity to transform to irreversible insurance coverage without needing to take another wellness examination. This can enable you to benefit from the extra benefits of a permanent plan.

Table of Contents

- – What are the benefits of Level Premium Term Li...

- – Who offers flexible Level Death Benefit Term L...

- – Why should I have Level Term Life Insurance P...

- – What are the benefits of Level Term Life Insu...

- – Can I get Level Term Life Insurance For Fami...

- – What is the difference between Level Term Li...

- – Who are the cheapest Affordable Level Term L...

Latest Posts

The Best Funeral Cover

What Type Of Insurance Is Final Expense

How Much Does Funeral Insurance Cost

More

Latest Posts

The Best Funeral Cover

What Type Of Insurance Is Final Expense

How Much Does Funeral Insurance Cost