All Categories

Featured

Table of Contents

- – What happens if I don’t have Low Cost Level Te...

- – What is the most popular Level Term Life Insur...

- – What types of Level Term Life Insurance Rates...

- – What should I know before getting Term Life I...

- – Why is Level Premium Term Life Insurance imp...

- – How do I compare Low Cost Level Term Life In...

Term life insurance coverage is a type of plan that lasts a details length of time, called the term. You select the length of the policy term when you first obtain your life insurance. It might be 5 years, two decades and even more. If you pass away during the pre-selected term (and you've stayed on top of your costs), your insurance firm will pay out a round figure to your nominated recipients.

Select your term and your quantity of cover. You might need to answer some concerns concerning your case history. Select the plan that's right for you. Now, all you have to do is pay your costs. As it's level term, you know your premiums will certainly stay the very same throughout the term of the plan.

What happens if I don’t have Low Cost Level Term Life Insurance?

Life insurance policy covers most conditions of death, however there will be some exemptions in the terms of the policy - Level term life insurance premiums.

After this, the policy ends and the enduring partner is no longer covered. Joint plans are normally more economical than single life insurance policies.

This safeguards the buying power of your cover quantity against inflationLife cover is a fantastic point to have due to the fact that it provides financial defense for your dependents if the worst happens and you die. Your loved ones can likewise utilize your life insurance policy payout to spend for your funeral. Whatever they pick to do, it's fantastic assurance for you.

Nevertheless, level term cover is terrific for meeting everyday living costs such as household expenses. You can also use your life insurance policy benefit to cover your interest-only mortgage, settlement home mortgage, college costs or any kind of various other debts or continuous payments. On the various other hand, there are some disadvantages to degree cover, compared to other sorts of life plan.

What is the most popular Level Term Life Insurance Vs Whole Life plan in 2024?

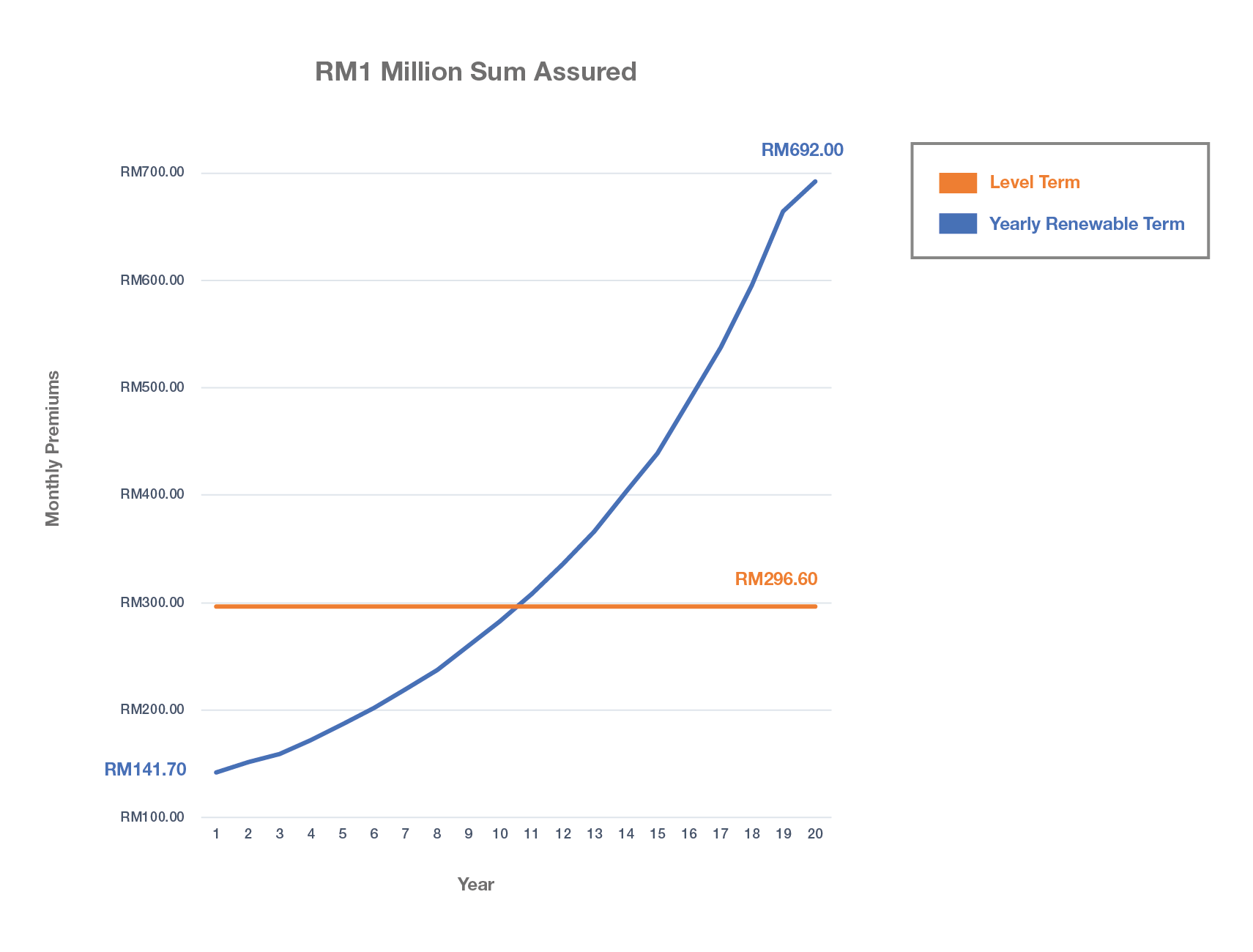

The word "degree" in the expression "degree term insurance coverage" means that this type of insurance policy has a fixed premium and face amount (death advantage) throughout the life of the plan. Simply placed, when people speak about term life insurance coverage, they generally describe level term life insurance policy. For most of individuals, it is the simplest and most budget-friendly choice of all life insurance policy types.

The word "term" below describes a given variety of years throughout which the level term life insurance remains active. Degree term life insurance policy is just one of one of the most popular life insurance policy plans that life insurance policy service providers supply to their customers due to its simpleness and affordability. It is also very easy to compare degree term life insurance policy quotes and get the most effective costs.

The mechanism is as complies with: Firstly, pick a plan, survivor benefit amount and plan period (or term length). Secondly, pick to pay on either a month-to-month or yearly basis. If your premature death happens within the life of the policy, your life insurance provider will pay a lump sum of fatality advantage to your fixed recipients.

What types of Level Term Life Insurance Rates are available?

Your degree term life insurance plan ends once you come to the end of your policy's term. Now, you have the adhering to choices: Alternative A: Remain without insurance. This alternative suits you when you can insure by yourself and when you have no debts or dependents. Alternative B: Get a brand-new level term life insurance policy policy.

FOR FINANCIAL PROFESSIONALS We have actually made to give you with the very best online experience. Your existing web browser could restrict that experience. You might be making use of an old browser that's unsupported, or settings within your browser that are not compatible with our site. Please save on your own some irritation, and upgrade your browser in order to watch our site.

What should I know before getting Term Life Insurance With Fixed Premiums?

Already making use of an upgraded internet browser and still having trouble? Your current web browser: Detecting ...

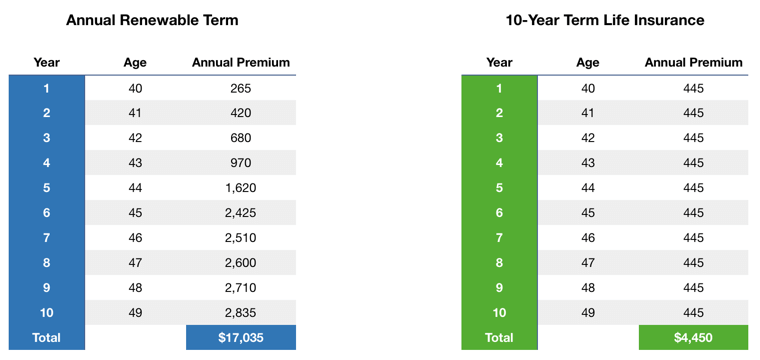

If the policy expires before runs out prior to or you live beyond the policy termPlan there is no payout. You may be able to renew a term plan at expiry, yet the premiums will be recalculated based on your age at the time of renewal.

Whole Life Insurance Policy Rates 30 $282 $247 40 $382 $352 50 $571 $498 60 $887 $782 Resource: Quotacy. Quotes are for a $500,000 permanent life insurance plan, for males and females in outstanding health and wellness.

Why is Level Premium Term Life Insurance important?

That decreases the total threat to the insurer contrasted to an irreversible life policy. The decreased risk is one variable that permits insurers to charge reduced costs. Rates of interest, the financials of the insurer, and state regulations can likewise influence premiums. In general, firms commonly supply better prices at the "breakpoint" protection levels of $100,000, $250,000, $500,000, and $1,000,000.

Check our recommendations for the best term life insurance coverage plans when you are all set to get. Thirty-year-old George intends to shield his family in the unlikely occasion of his passing. He purchases a 10-year, $500,000 term life insurance policy with a premium of $50 monthly. If George dies within the 10-year term, the plan will certainly pay George's recipient $500,000.

If he remains alive and restores the plan after one decade, the costs will certainly be higher than his initial plan since they will be based on his current age of 40 rather than 30. Level term life insurance for families. If George is diagnosed with an incurable ailment during the first policy term, he most likely will not be qualified to renew the plan when it expires

There are numerous types of term life insurance policy. The ideal option will certainly depend on your individual situations. Many term life insurance policy has a degree premium, and it's the type we've been referring to in many of this article.

How do I compare Low Cost Level Term Life Insurance plans?

They may be an excellent choice for someone who needs temporary insurance. The insurance policy holder pays a taken care of, level premium for the period of the plan.

Table of Contents

- – What happens if I don’t have Low Cost Level Te...

- – What is the most popular Level Term Life Insur...

- – What types of Level Term Life Insurance Rates...

- – What should I know before getting Term Life I...

- – Why is Level Premium Term Life Insurance imp...

- – How do I compare Low Cost Level Term Life In...

Latest Posts

The Best Funeral Cover

What Type Of Insurance Is Final Expense

How Much Does Funeral Insurance Cost

More

Latest Posts

The Best Funeral Cover

What Type Of Insurance Is Final Expense

How Much Does Funeral Insurance Cost